Today I’m going to list some tools I often use whenever I’m in the market for a new car. Most of these tools are handy regardless of whether you are buying or leasing your next car.

Find the right car with Autotrader

One of the quirks of car buying in America is that ever car deal is made over a single car. You spend hours haggling with the dealer over price, but then you want a different color, or want to add some options – oops you might have to start over. I always use autotrader.com when trying to find the right car across the inventory of multiple dealerships in my city. This is a very efficient way to filter for dealerships that have the right trim level, drivetrain & color combination. Sometimes it doesn’t hurt to stretch your search to a slightly larger geography either. Especially if that 3 hour drive could save you $3000 dollars.

Getting the best lending rates for auto loans

Auto loans are a very lucrative source of revenue for car dealerships. Having your own financing can not make the car buying process simpler for you & also eliminate hidden costs. Negotiating the price with a dealer also becomes simpler since you only need to agree on the sale price of the car, and review all the line items to arrive at a amount for the check.

Head over to any major retain lending aggregator site like lendingtree.com , mint.com or bankrate.com to find the best loan rates for your credit profile. Many banks (eg. Capital One loan navigator) also offer a fully online auto loan application process that can get you a decision in minutes.

If you have tier 1 credit, you should also explore the auto makers own financing offers. Many automakers often offer promotional loan rates to incentivize sales. You can usually find these with a quick Google search eg. ‘Honda national finance offers’ would send you to this page that lists the current lending rates from Honda’s financing arm. Do not confuse the loan offers from Honda’s financing with Dealer financing. Dealer financing is most likely more expensive than other available options, and dealers commonly use this as a tactic to recoup margins lost from the discounts they provided on the sticker price of the car.

Don’t lock your rate until you’ve explored all the borrowing options. In summary here’s all the options you should consider:

- Loan aggregator sites (like lending tree mentioned above)

- Local credit unions

- Personal line of credit

- Automaker’s financing (not to be confused with dealer financing)

Browse fully online dealerships for used cars

If you are looking for a used car, consider browsing all the major used car dealerships:

- Shift.com

- Vroom.com

- Carvana.com

These dealers provide a seamless purchase experience, that can help buyers avoid the hassles of haggling with salesman & running into sneaky fees & add-ons. However, if you are willing to put in the work to negotiate then you might land a better deal with a brick & mortar dealer as they have more leeway in selling prices.

Know how much your current car is worth

For many Americans buying a new car usually involves selling their old one. Few people know that car dealers in America make more money off of used car sales than new car sales.

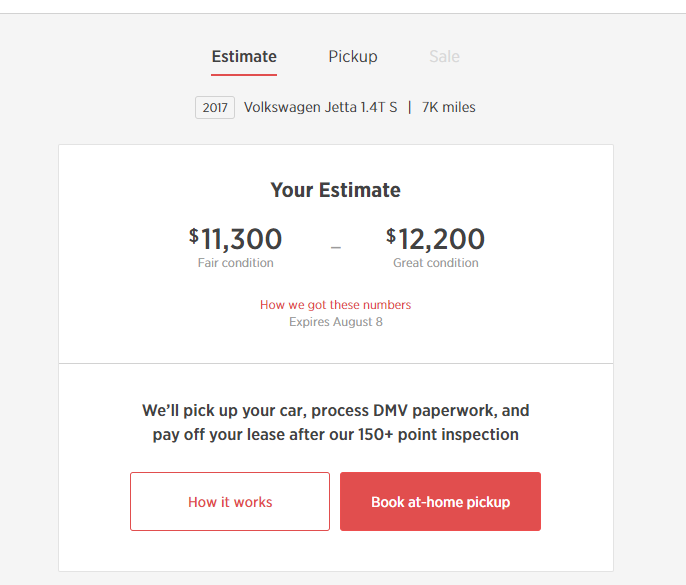

Online dealers are also a great tool for knowing how much your current car is worth, and in many cases they will offer you the highest price to buyout your current car. All 3 major online dealers (Shift, Carvana & Vroom) have a fully only experience for selling your current car. You can usually get a quote that locks your sale price for a few weeks, just with a few simple clicks.

You can also use a site like KBB, but the online dealers quote carries more weight in my opinion because it is a real purchase offer for your car. KBB also offers an ‘instant offer’ product, that has in my experience yielded a series of low ball offers that are thousands below the prevailing market value of the car.

Even if you intend to trade-in your car at the dealership, getting a quote provides you more bargaining power & transparency in the car buying process.

Are there any more tools or tips about car buying that you’d like to see? Let me know in the comments below!